This flood season that has been happening in Malaysia really affects a lot of people badly. The effects are not just financially towards all of the victims but also include emotionally and mentally. A lot of people really need time for them to recover from all of the challenges that they have to go through. Hopefully, there would be light at the end of the tunnel for these people. Luckily, there is indeed one thing that the flood victims can do to lighten their burdens.

The thing that they can do is to claim the insurance for their own cars that got hit critically by the floodwater. Its primary use is actually to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in the car. It also may additionally offer financial protection against theft of the car, and against damage to the car sustained from events other than traffic collisions, such as keying, weather, or even natural disasters, and also damage sustained by colliding with stationary objects.

@wapcar_adrian Moga semua yang dikesan banjir, dipermudahkan segala urusan 🙏 #daruratbanjir #learnontiktok ♬ original sound – WapCar.my

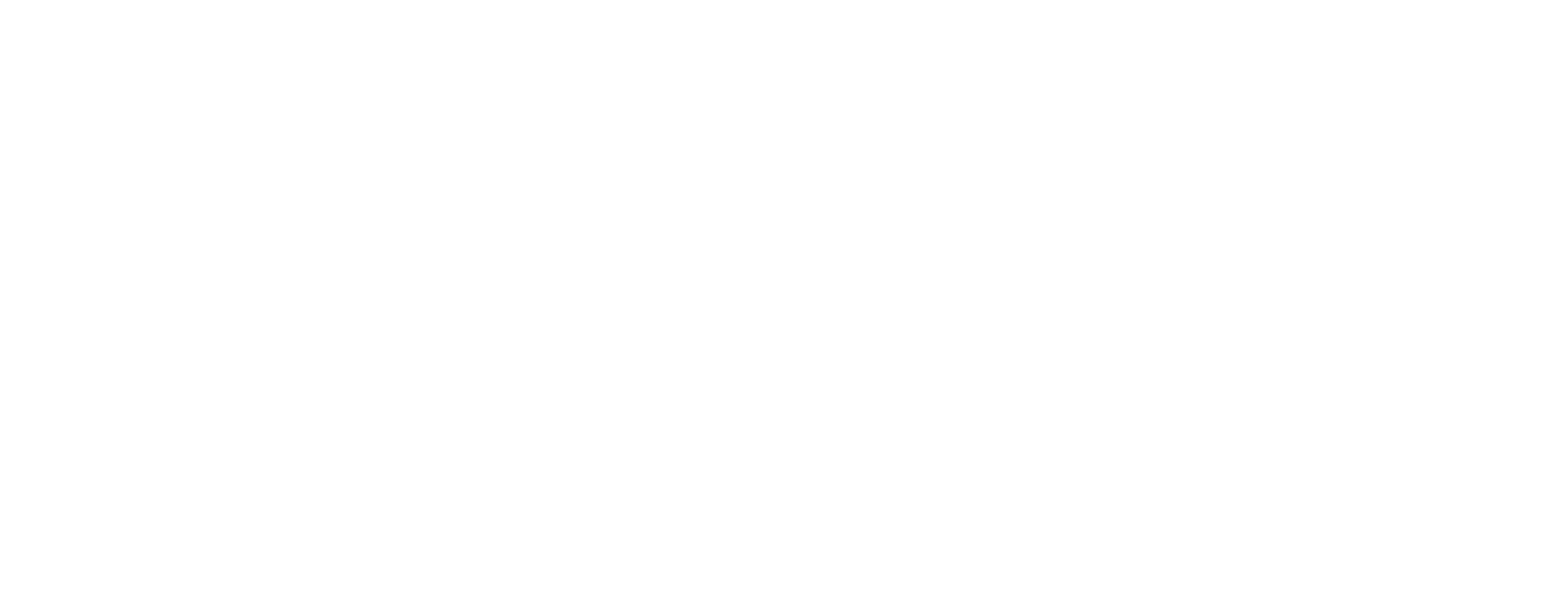

Please be reminded that only those who buy cover for Special Perils or even natural disasters are eligible for a claim. For those who might not know, these are the 4 simple steps to claim insurance for cars that got affected by the flood.

- Take pictures of your car. Make sure to take note of the location, date, and also time of when your car got affected by the floodwater. The best picture would be your car that shows the number plate as evidence.

- Lodge a police report. The insurance people would ask for a copy of the police report to make a claim. The police report needs to be done within 48 hours.

- Do not start your car’s engine. Straight away tow your car. If you try to start your car that has been affected by the floodwater, the engine of the car would be broken and the insurance people would use your mistakes as an excuse to not approve your claim.

- Tow your car to the workshop or even to the factory so that your insurance process would be faster.

Sources: TikTok wapcar_adrian.

Leave a Comment