Do you find filing your taxes a tedious process? You have to go to LHDN, wait in line and fill in many forms. As you’re busy with work every day, it’s hard to allocate time to do it. Therefore, you might put this task at the end. As a result, you forgot to file your taxes. Oh no!

These days, it’s easier to deal with many things with technology. Now, filing your taxes can be done online too. You don’t have to wait in line for a long time!

Care to know how? Dappnology shared the tips and tricks that will make your life easier.

How to file taxes online?

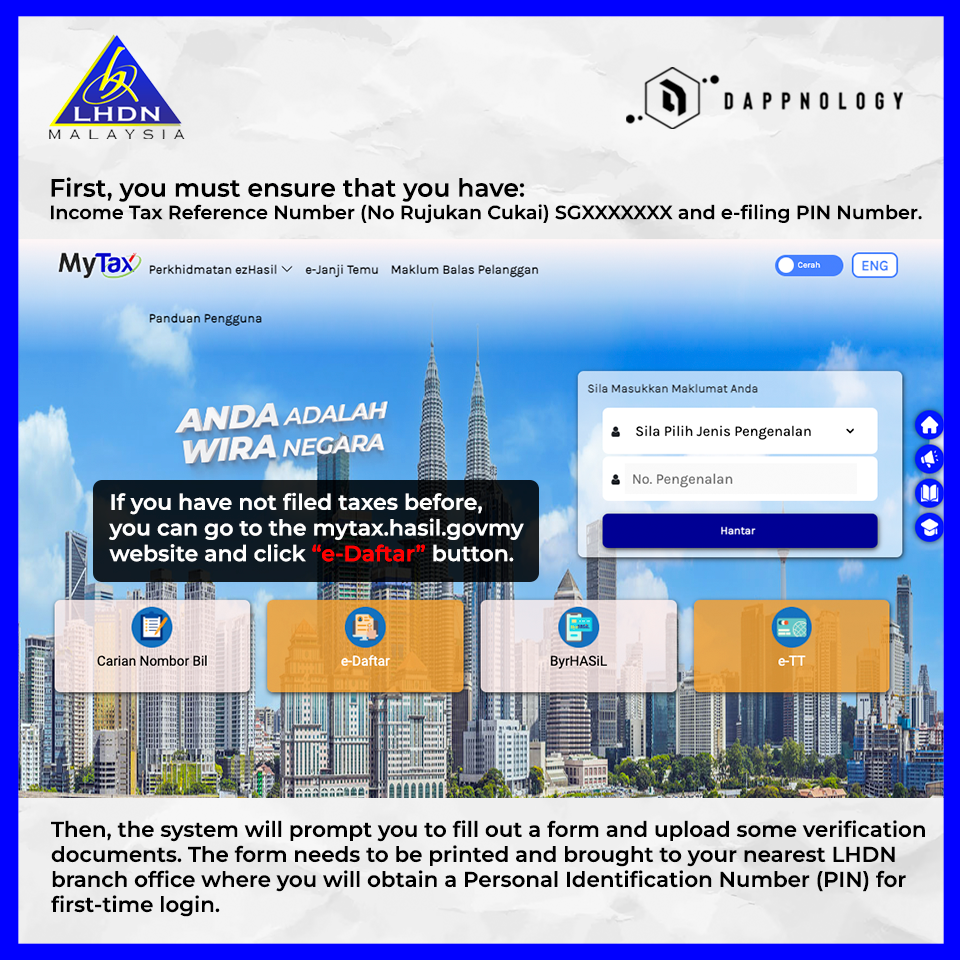

Firstly, you must have:

- Income Tx Reference Number (No Rujukan Cukai) and e-filing PIN.

However, if you have never filed taxes, go to mytax.hasil.gov.my and click e-Daftar.

- Then, the system will prompt you to fill out a form and upload verification documents.

- The form has to be printed and brought to your nearest LHDN office.

- There, you will get a Personal Identification Number (PIN) for first-time login.

Follow these steps

1) Login

- Go to the new MyTax website.

- Login using the First Time Login option.

- Then, the system requires you to create a new password for your online account (make it as secure as possible).

2) Select the tax form

- Click on the ezHasil Services menu in the top left corner.

- Select e-filing.

- Click on the income tax form for the appropriate tax year.

- Note: this option depends on the type of income tax you’re filing.

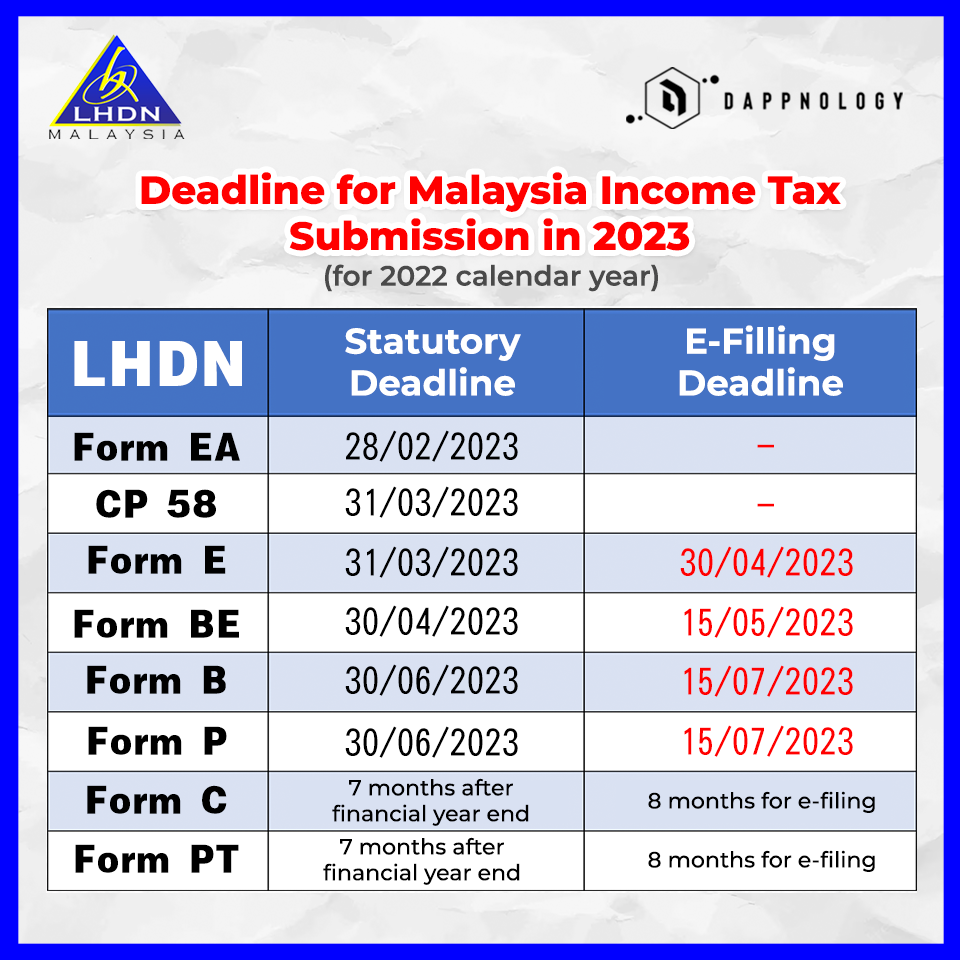

- Refer to this table:

3) Fill in the details

The tax form for employees is Borang e-Be. Thus, fill in:

- Personal information

- Income

- Tx deduction

Important notes:

- Keep all documents related to the tax deductions for future reference.

- The system will display 0 in the amount payable section if the tax deductions don’t reach the tax payment threshold.

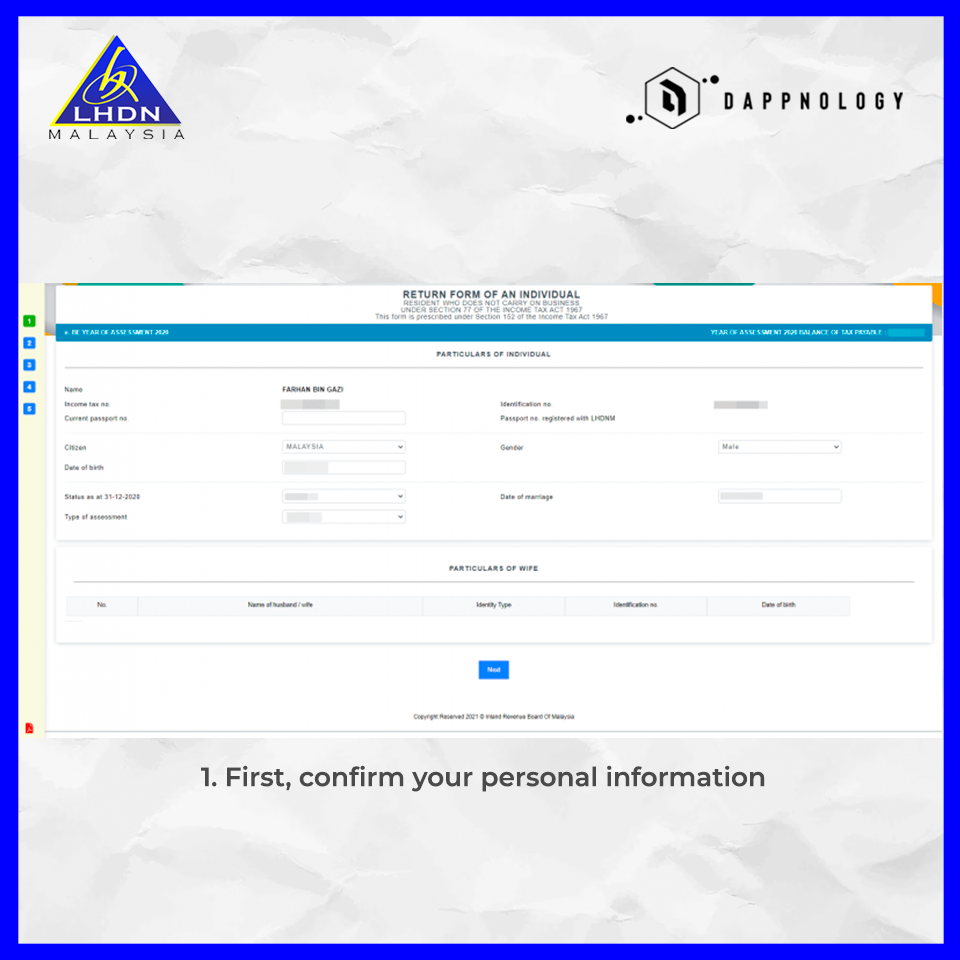

a) Confirm your personal information

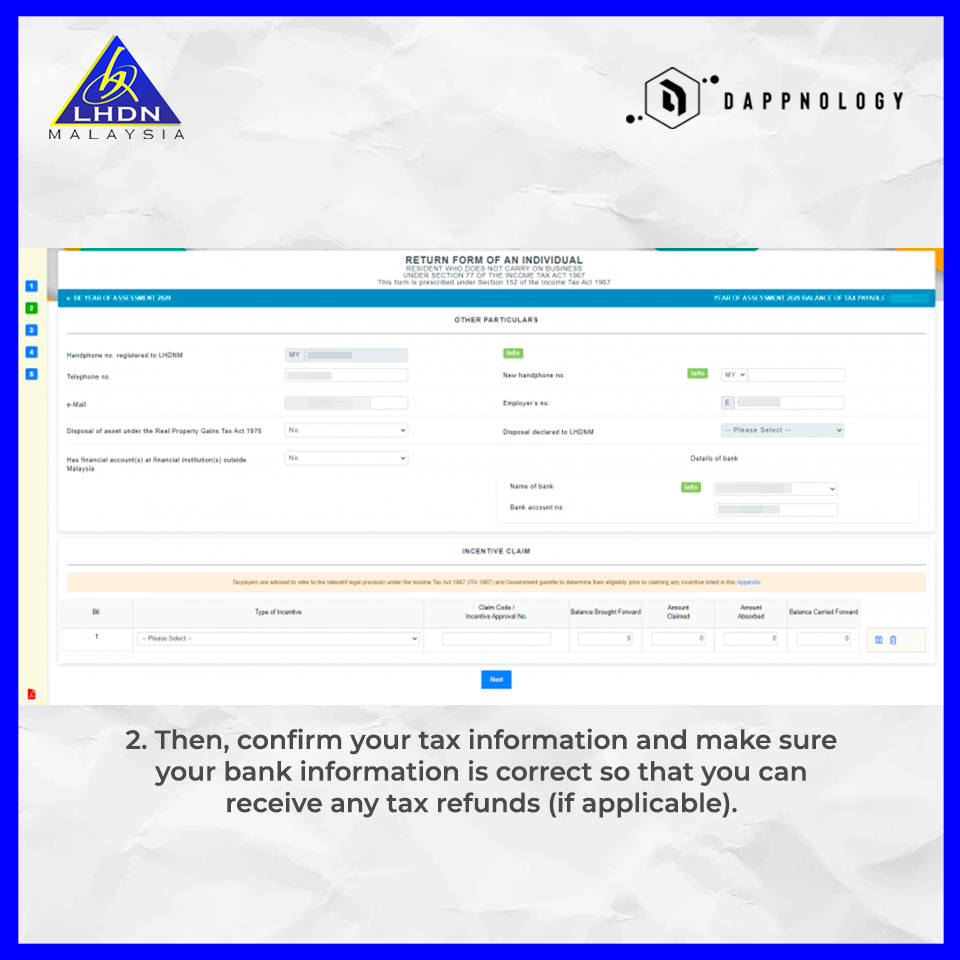

b) Next, confirm your tax information.

- Ensure your bank information is correct to receive any tax refunds (if applicable).

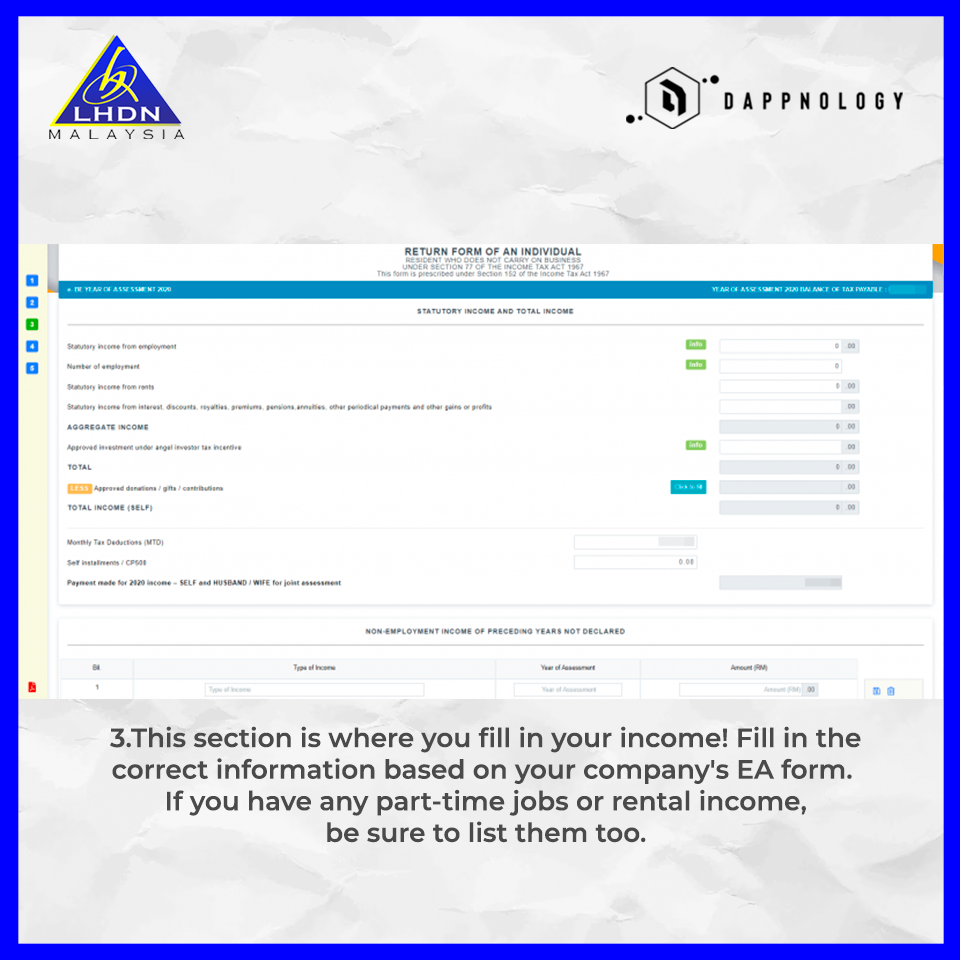

c) Fill in your income and the correct information based on your company’s EA form.

- If you’re doing any part-time or rental income, include them too.

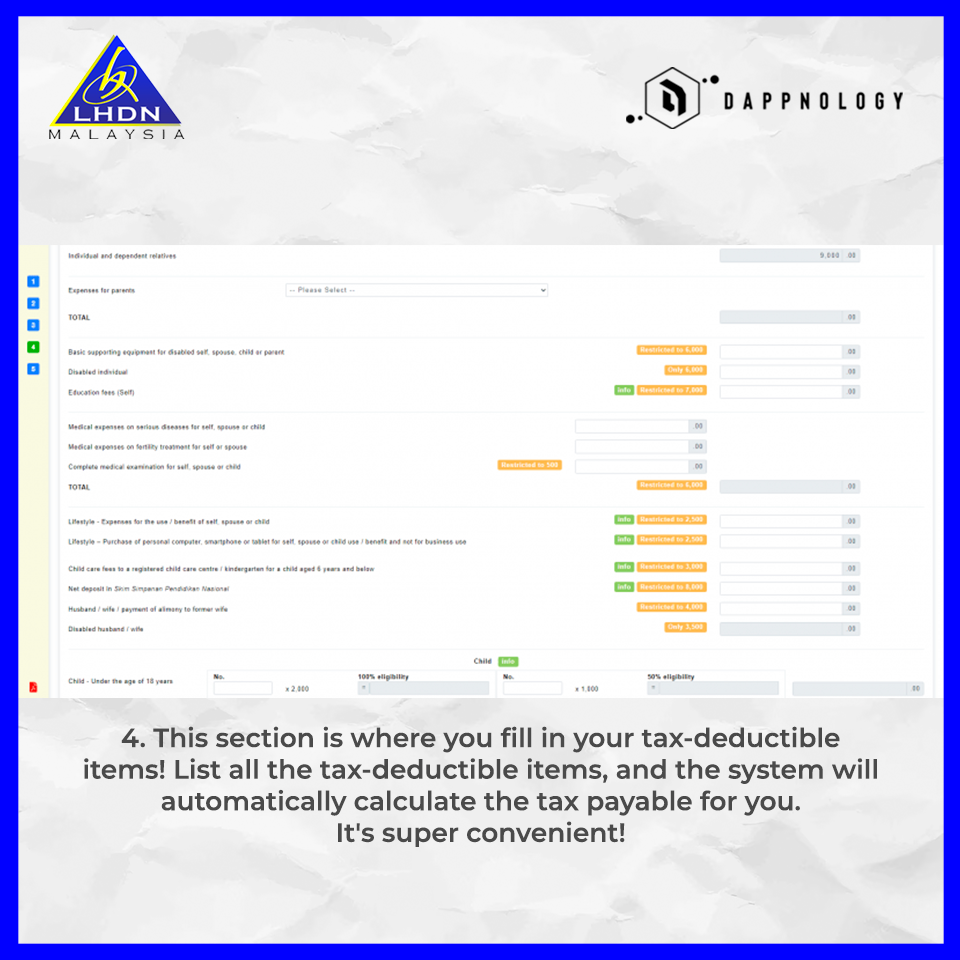

d) Add in your tax-deductible items. List all the tax-deductible items.

- The system will automatically calculate the tax payable to you.

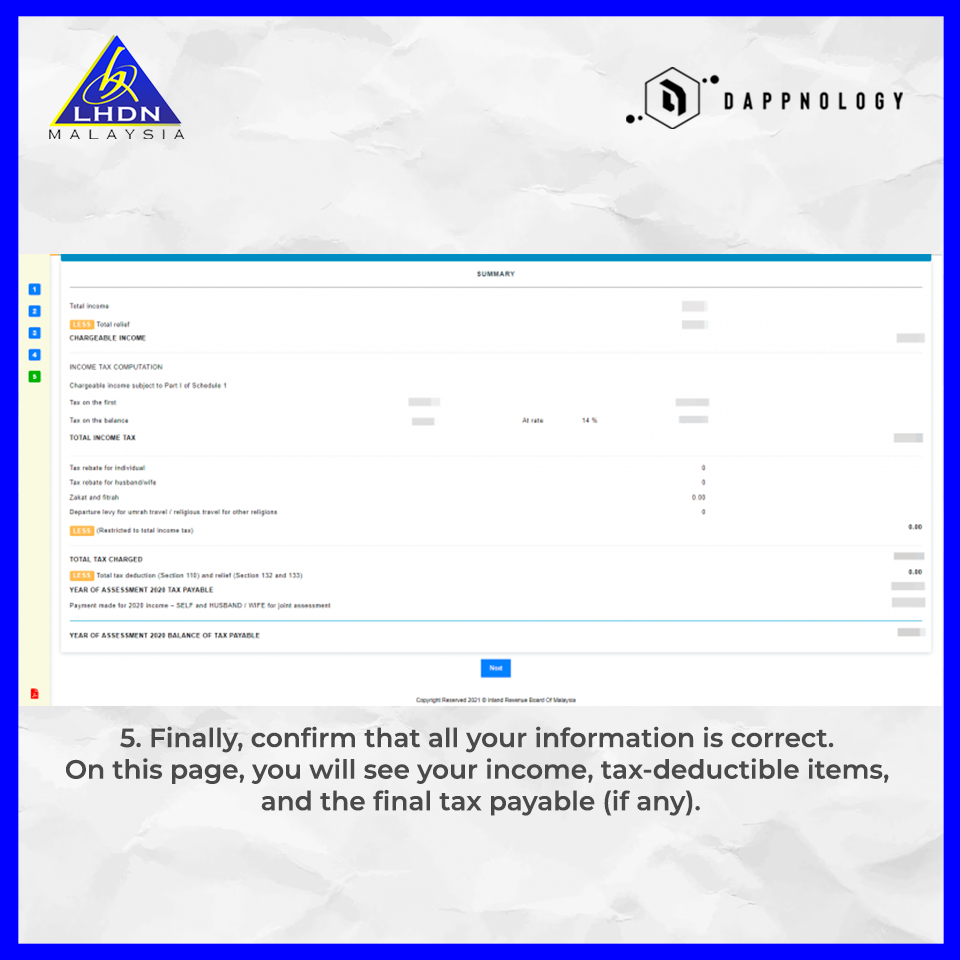

e) Lastly, re-check your information.

- You’ll see your income, tax-deductible items, and the final tax payable (if any) on this page.

4) Submit

- After confirming all details, click on Teruskan in the Rumusan section.

- Afterwards, click Tandatangan & Hantar, leading to the Pengesahan Penerimaan page.

- You’ve successfully filed your tax return!

Source: Facebook Dappnology